I keep getting many questions from friends and peers on LinkedIn from India and Australia about my CPA Aust. Program. To answer this I am writing this article, what CPA is, why I started this program and how you can register for the same.

So, I am a qualified Indian Chartered Accountant with 3.5 years of experience in Accounting and tax in India. I recently got married and since my husband job was located in Australia, we decided to migrate there for long time and build our careers there.

Why I started this program

As soon as I moved there, I realised that job environment in Australia is not easy and you need to have local experience and good contacts to get your preferred job there. Also it is beneficial if you have a local recognised accounting degree because most employers ask for a CPA or CA ANZ for good accounting, audit or tax roles. So, I explored my options between CPA Aust. and CAANZ and decided to go for CPA Australia as it suited my requirements, also I had to go only for 1 paper- Global Strategy and Leadership(GSL) and 1 online test for Governance and Accountability.

I had attended one of the “Become A CPA Information Session” in Melbourne and there met many people like me from India, China, Sri Lanka who had migrated to Australia recently and looking for career options in accounting. I was happy to see the kind of network these platforms help you build and we were guided by qualified CPA’s and mentors already working in Australia. Here I will like to state after that I attended many workshops and seminars conducted by CPA Australia and thankful for their such inclusive knowledge sharing networks. Now I am in India and still committed to accomplishing my CPA status and here in India also I get ample opportunities to attend CPA chapters.

What is CPA Australia? taken from CPA website

CPA Australia (“Certified Practising Accountant”) is a professional accounting body in Australia founded in 1886, with 164,695 members. A CPA is a finance, accounting and business professional with a specific qualification. Being a CPA is a mark of high professional competence. It indicates a soundness in depth, breadth and quality of accountancy knowledge.

How to register for it and who can benefit

The first step will be to visit the CPA website https://www.cpaaustralia.com.au/become-a-cpa and collect more information about the course, depending on your qualification whether a graduate in commerce or any other recognised Professional accounting degree you possess in India or your home country, you can get exemptions in certain examinations of CPA Program. The final level known as CPA Program has 6 papers.

The elective subjects are:-

- FINANCIAL PLANNING FUNDAMENTALS

- ADVANCED TAXATION

- ADVANCED AUDIT & ASSURANCE

- FINANCIAL RISK MANAGEMENT

- RISK ADVICE & INSURANCE

- CONTEMPORARY BUSINESS ISSUES

- INVESTMENT STRATEGIES

Step 1. Application to Become CPA

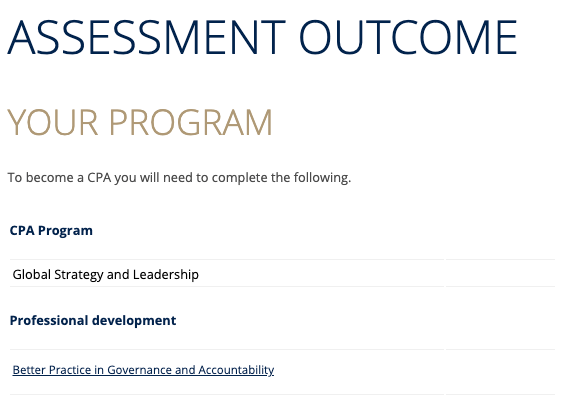

To know which subjects you are eligible for exemption you have to start with the Application process with CPA Institute, who will then share with you the assessment outcome. In the application you have to submit all your details of education, work experience and pay an application fee. Application fee is AUD 164, but you can get a promo code or something when you attend the CPA Information session in person and redeem it against application fee.

The link to apply for CPA Program is – https://apply.cpaaustralia.com.au/

The assessment outcome may look something like this depending upon your experience:-

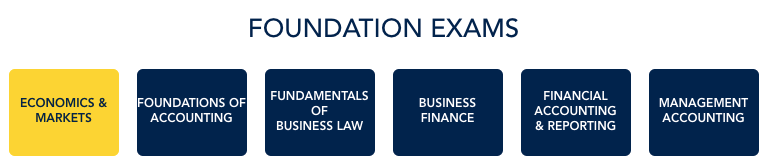

But if you are coming altogether from a different discipline you have to start with CPA Foundation which have 5 subjects as below:-

Step 2. Membership Fees

Unlike other professional accounting programs like Chartered Accountancy of ICAI which give you to use their name “CA” only on becoming fully qualified, CPA Aust. give membership to its students at the time of registering for the course, so you can use the words APA Aust. (Associate Practising accountant) besides your name and show your commitment to prospective employers towards your education. On completing the program you are entitle to use CPA Aust. title besides your name. Membership fees for the year is AUD 325, for half year is AUD 162.5 depending when you join the program. As a member you are eligible to access many online resources of CPA Aust. and there library. Note fees keep changing so visit https://www.cpaaustralia.com.au/member-services/fees/australia for updated details.

Step 3. Enrolling for the subject

You are enrolled for a subject or many subjects per semester, for example I enrolled for GSL paper soon after my assessment outcome. One subject enrolment will cost you around AUD 1140. After successful enrolment and payment you will receive your study material in hardcopy from CPA Institute and also many online resources to help you guide throughout your semester. To help in your studies you can also form a study groups with students enrolled for same subjects in your area. Exam are held twice a year in April/May and September/ October. Results announced a month later.

Overall my experience with the CPA Aust. was really good, I was able to connect with many people like me and also became part of ICAI chapters in Melbourne through this network. I decided to take it so that I can get local accounting body recognition as I have plans to work in Australia for long time. If you have any questions you can also reach the CPA Aust. support phone nos.: 1300737373 (within Australia) and +61 396069677 (outside of Australia). Hope this helps you in your decision to pursue the course, if you have any queries please reach me on fcasnehasingh@gmail.com.